Research breakthroughs, changing materials supply chains, and unprecedented investments and activity mark an evolving battery world that is remaking ours.

December 16, 2022

In a world facing powerful and existential climate crises, governments, utilities, research institutions, and businesses across many industries and borders are embracing and accelerating what has been called “the electrification of everything.” Effective energy storage is crucial to the movement, and at its center is the battery.

Efforts to address the challenges surrounding battery design and chemistries, access to materials, scaling production advances, and the emergence of potent recycling approaches are resolving into a robust, circular techno-economy that spans sciences, economies, and even politics to create a battery-centric ‘Brave New World,’ even as our current world is processing the changes and their implications. This series of articles will attempt to survey the geography of this new world.

The Roadmap

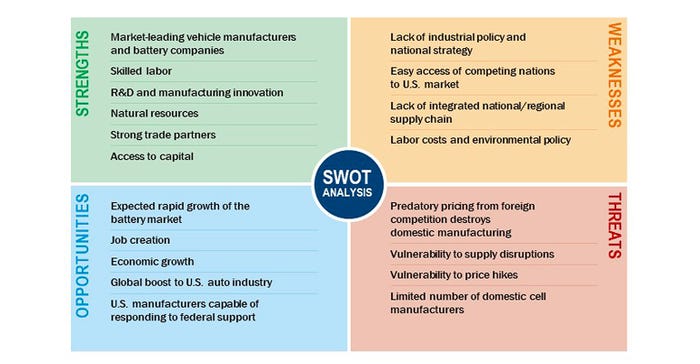

In 2021, the United States Departments of Energy, Defense, Commerce, and State, together with other federal agencies and academic institutions, came together to form the Federal Consortium for Advanced Batteries (FCAB). The consortium itself is an example of the many vital areas of society and government batteries address. For lithium-ion batteries alone, the worldwide market is expected to grow by a factor of five to 10 in the next decade, this from FCAB’s National Blueprint for Lithium Batteries 2021-2030. “Establishing a domestic supply chain for lithium-based batteries requires a national commitment to both solving breakthrough scientific challenges for new materials and developing a manufacturing base that meets the demands of the growing electric vehicle (EV) and stationary grid storage markets,” says Secretary of Energy Jennifer Granholm by way of introduction.

The FCAB roadmap identifies five goals:

Secure access to raw and refined materials and discover alternatives for critical minerals for commercial and defense applications.

For a stronger, more secure, and resilient supply chain for battery materials, the goal is to reduce U.S. lithium-battery manufacturing dependence on scarce and largely foreign-based materials, especially cobalt and nickel.

Support the growth of a U.S. materials-processing base able to meet domestic battery manufacturing demand.

Eliminating critical minerals such as cobalt and nickel from lithium batteries, and establishing new processes that decrease the cost of battery components such as cathodes, anodes, and electrolytes, will be key enablers of future growth.

Stimulate the U.S. electrode, cell, and pack manufacturing sectors

The U.S. should develop a federal policy and R&D framework that supports manufacturing electrodes, cells, and packs domestically and encourages demand growth for lithium-ion batteries.

Enable U.S. end-of-life reuse and critical materials recycling at scale and a full competitive value chain in the United States

In addition to recycling, a resilient market must include the reuse of battery cells from retired EVs for secondary applications, including grid storage. Reuse of battery cells requires proper sorting, testing, and balancing of cell packs.

Maintain and advance U.S. battery technology leadership by strongly supporting scientific R&D, STEM education, and workforce development

Billions and Billions

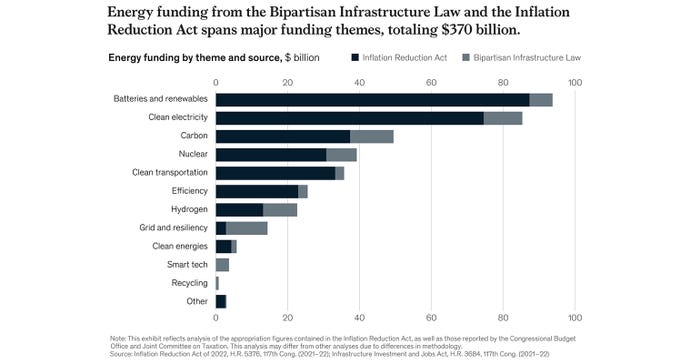

Fast-forward to 2022, and the central role of batteries in the bi-partisan Inflation Recovery Act (IRA). According to McKinsey & Co.’s Public Sector Practice, this is the third piece of federal legislation passed since late 2021 seeking to improve US economic competitiveness, innovation, and industrial productivity. The Bipartisan Infrastructure Law (BIL), the CHIPS & Science Act, and the IRA partially overlap, but together introduce $2 trillion in new federal spending over the next ten years.

Clean electricity and transmission command the biggest slice, followed by clean transportation, including electric-vehicle (EV) incentives. $394 billion in energy and climate funding is in the form of tax credits. Corporations are the biggest recipients, with an estimated $216 billion worth of tax credits designed to catalyze private investment in clean energy, transport, and manufacturing. Many tax incentives are direct pay, meaning an entity can claim the full amount even if its tax liability is less than the credit.

Batteries and renewables form the largest funding portion of BIL and IRA incentives, but there are points to pay close attention to, including domestic-production or domestic-procurement requirements. For example, to unlock the full EV credit for consumers ($4,000 per vehicle), the battery must have been manufactured or assembled in North America and a scaling percentage of critical minerals in the battery must have been recycled in North America or been extracted or processed in a country that has a free-trade agreement with the United States.

Billions are in place and the boom is under way.

Part 2 will feature more details, projects, and voices from the manufacturing and supply chain responses to the emerging battery world.

About the Author(s)

You May Also Like