Omdia did a deep dive into the battery energy storage system (BESS) industry and came back with insights about new battery chemistries, manufacturers and their challenges, the state of the global market, and more. Here are five takeaways.

May 15, 2023

The demand for renewable energy resources has increased significantly as the world transitions towards a more sustainable future. But renewable energy resources such as solar and winds are only intermittently available, which makes energy storage systems essential to ensure a reliable power supply. Here are five takeaways from Omdia’s report, titled “Market Landscape: Battery Energy Storage Systems” by Moises Levy, PhD, data center power and cooling research lead at Omdia.

Battery applications in datacenters

The datacenter industry is benefiting from all the battery advancements in the battery field—driven mainly by the electric vehicle (EV) industry. Omdia expects the UPS battery market to grow at a 9.8% compound annual growth rate (CAGR) from 2021 to 2030, reaching $4B by 2030. Dr. Levy identifies the following three main battery applications in the datacenter industry:

UPS systems: As mentioned in a previous article, the datacenter industry has started to displace traditional lead-acid batteries with new battery technologies for backup power. Uninterruptible Power Supply (UPS) batteries are used only in case of a power outage or disturbance. According to Omdia’s UPS Hardware Market Analysis–2022, global UPS hardware market revenue will reach $14.4B in 2026 at a 7.8% CAGR from 2021 to 2026.

Microgrids: Dr. Levy highlights the benefits of incorporating battery ESS into a microgrid solution to store energy and supply it during outages or when the grid demands it. Battery ESS can improve the flexibility and resiliency of the smart electric grid. It can also be seen as a component contributing to integrate renewable energy resources (e.g., wind, solar) into the power equation.

Smart-grid-ready UPS: This technology (a.k.a. grid interactive UPS) enable the flow of energy bi-directionally. Different modes of operation include standard operation, energy demand management, and fast frequency response, contributing to improve the reliability and stability of the electric grid.

Omdia expects the smart grid-ready UPS market to target UPS power ratings above 100kVA, anticipating improvements to the technology’s feature set over time. Omdia forecasts revenue to grow at a 44% CAGR from 2021 to $376M in 2026.

New battery chemistries

The search for higher battery density continues. Despite the increased adoption of new battery chemistries (e.g., sodium-ion, nickel-zinc, and liquid metal) in the data center industry, Omdia expects them to make up only about 10% of the UPS battery opportunity by 2030. Omdia also expects that lithium-based battery adoption for UPS in data centers will continue its fast growth. It is expected to dominate the UPS battery market, reaching 65% of global revenue by 2030.

Challenges in battery manufacturing

Building a large-scale battery factory is a lengthy process that can last about two to five years. In addition, most of the critical materials used for batteries are mined in resource-rich countries and controlled by a few major companies.

Regarding lithium-based batteries' mining and manufacturing capacity, China currently controls approximately 63% of the cathode share, 84% of the anode share, 66% of separators, and 69% of electrolytes. China also accounts for 80% of the announced additional production capacity to 2030 for copper and dominates the announced refining capacity of critical metals used in batteries.

The Russia-Ukraine conflict also affects the battery metals market, the world with vulnerabilities in the primary supply chain (raw materials), mineral refining and processing, domestic battery material production, and recycling markets.

Main battery manufacturers

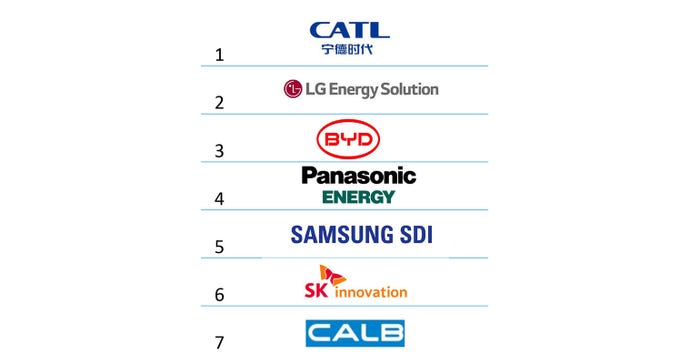

The global battery manufacturing capacity is growing but needs to scale up further to meet the growing demand for EVs and cleaner energy technologies. Omdia estimates battery manufacturer rankings based on market share. These manufacturers represent about 80% of global lithium-based battery market revenue, and all have headquarters in Asia & Oceania.

CATL is the leader in this space, with about one-third of market revenue, followed by LG Energy Solution and BYD. The top three leaders account for about 60% of global lithium-based battery market revenue. According to Omdia, the leading Lithium-based battery manufacturers are the following:

The future of the battery market

Many governments worldwide are actively working to support the battery supply chain and innovation since significant growth is expected. For example, the US government is incentivizing local battery innovation and production. The Infrastructure Investment and Jobs Act (US) provides about $7B for battery material processing, component/cell manufacturing, and recycling, plus another $7.5B to build out a national network of EV chargers. At the same time, private industry players, such as automobile manufacturers, are investing significantly in EVs, including new assembly and battery factories.

In 2023 and 2024, lithium-based and lead-acid batteries are expected to have an equal share of the UPS battery market in terms of revenue. After 2024, Omdia expects faster adoption of lithium-based batteries. Omdia expects the lithium-based batteries to lead the UPS battery market, growing at a 16.9% CAGR from 2021 to 2030 to reach 65% of global revenue and displacing lead-acid batteries.

According to Omdia, the global battery market will continue to grow, driven mainly by the EV industry. EVs use primarily lithium-based batteries, which offer improved performance, higher energy density, faster charge times, a longer lifecycle, higher operating temperatures, lower weight, and smaller footprint.

You May Also Like