Tesla Growth Stagnates: Musk Calls for Anti-China Protectionism

In Tesla’s Q4 2023 earnings call, CEO Elon Musk highlighted energy storage growth and warned that China EV makers could ‘demolish’ competitors if not stopped.

At a Glance

- Tesla's Q4 2023 earnings report shows growth stagnation.

- Energy storage is a bright spot, however.

- CEO Elon Musk warns that China EV companies can only be stymied with protectionist measures.

In Tesla’s 2023 Q4 earnings call, held on January 24th, the company reported delivery of over 1.8 million vehicles in 2023 (a year that had seen a number of vehicle price cuts) and noted that the Model Y is not just the best-selling EV but rather the best-selling car of any kind on the planet. But it also reported revenue growth of just 3.5%—much weaker than industry-watchers had expected.

The two biggest surprises on the call were the strength of the energy storage segment of the business and Tesla CEO Elon Musk’s stark warning about the prowess of China’s EV makers. Here are some highlights from the report and call.

Beware of China

In the Q&A portion of the earnings call, Musk was asked his thoughts on the topic of China-based OEMs expanding into Western markets: “As the China market kind of gets saturated and there's a tremendous growth in the supply, how much success should Tesla investors allow for this competition to achieve in Western markets?”

Musk replied that “Chinese car companies are the most competitive car companies in the world. I think they will have significant success outside of China depending on what kind of tariffs or trade barriers are established. Frankly, I think if there are not trade barriers established, they will pretty much demolish most other car companies in the world.”

This stark warning shows an evolution of Musk’s thinking on China’s car companies. In 2011, he was minimizing their importance, citing the lower quality he then saw in EVs from the likes of BYD. But in May 2023, he noted that BYD cars were highly competitive. BYD went on to become the world’s best-selling EV company in Q4 2023, beating out Tesla for the first time.

Tesla Model Y. Image courtesy of Tesla

Model Y is the best-selling vehicle on the planet

The company is at the top in one metric, however: The earnings report stated: “In 2023, we delivered over 1.2 million Model Ys, making it the best-selling vehicle, of any kind, globally. For a long time, many doubted the viability of EVs. Today, the best-selling vehicle on the planet is an EV.”

Musk underlined the data on the earnings call: “Model Y became the best-selling vehicle globally, as predicted. The best-selling vehicle of any kind, not just electric vehicles, with over 1.2 million units delivered.”

A bright spot: Energy storage

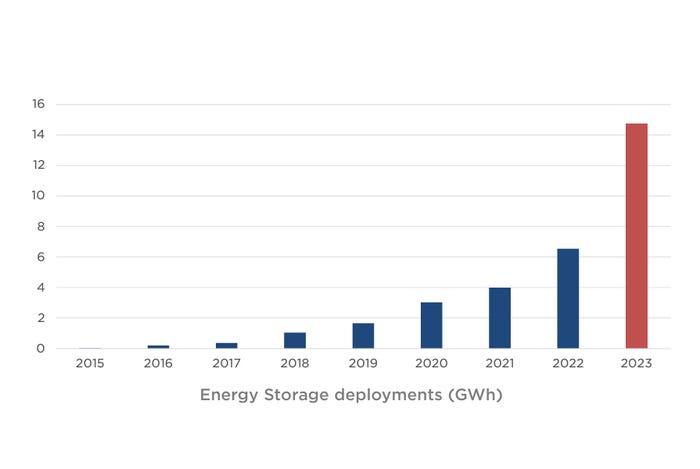

While EV sales slowed, the company’s stationary energy storage business is doing better than ever, according to the earnings report. Earnings call presentation material stated, “Energy storage deployments reached 14.7 GWh in 2023, more than double compared to the previous year, while Energy Generation and Storage business profits nearly quadrupled in 2023.”

Image courtesy of Tesla

Musk commented, “The energy storage business delivered nearly 15 gigawatt hours of batteries in 2023, compared to 6.5 gigawatt hours the year before. So tremendous year-over-year growth, triple-digits. And yeah, I think we'll continue to see very strong growth in storage, as predicted. I said for many years that the storage business would grow much faster than the car business, and it is doing that.”

“This business is poised to again surpass our auto business in terms of growth rate in 2024,” he later elaborated. “This has been in the works for quite some time with us laying the foundation a few years back by building our Megafactory in Lathrop [CA].”

Megapack production line. Image courtesy of Tesla.

Learning from experience regarding production

Asked about the timeline of expansion of Giga Nevada and Giga Mexico, Tesla VP Supply Chain Karn Budhiraj said that the company wants to “first demonstrate success with the next-generation platform in Austin before we start construction. Therefore, we have started the long lead work to get the basics ready and plan to follow our recipe from the 3/Y ramp with Shanghai, where we started with learnings from Fremont and ramp really quickly.”

Musk elaborated on the value of learning from past experience.

“Model 3 production was three years of hell. Some of the really worst years of my life, frankly,” Musk said. “I still have mental scar tissue from those three years, as do many.”

However, Model Y production setup was “a much easier situation” because the car is somewhat a variant on the Model 3, he noted. And the company was then able to improve Model Y production as they implemented new lines in Shanghai and Berlin.

“And that's the sensible way to go about things: Figure out the core technology of the manufacturing line and then replicate it with improvements throughout the world.”

About the Author(s)

You May Also Like