Find Out Which Are The Top 30 US Electric Vehicle Supply Equipment Cities

A just-released corporate site selection report by The Boyd Company names 30 US cities poised to attract new manufacturing investment and jobs in the growing Electric Vehicle Supply Equipment (EVSE) Industry.

April 26, 2023

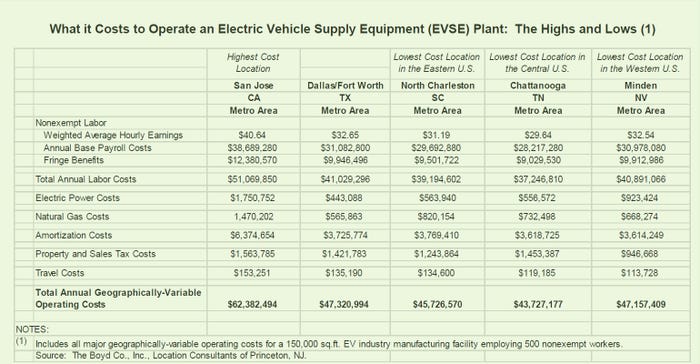

A just-released 2023 corporate site selection report by The Boyd Company Inc., names 30 US cities poised to attract new manufacturing investment and jobs in the growing Electric Vehicle Supply Equipment (EVSE) Industry. The report compares annual operating costs for a typical EVSE manufacturing plant in each of the surveyed cities. Meanwhile, a comparative cost analysis shows that operating costs for a 500-worker EVSE plant range from a high of $62.4 million in San Jose, CA, to a low of $43.7 million in Chattanooga, TN.

The electric vehicle supply equipment (EVSE) market is projected to grow from $7B in 2023 to $100B by 2040, led by charge point operators (CPOs) which manufacture, operate, and service electric vehicle (EV) charging stations. According to a recent PwC analysis, the EV charging market will need to grow nearly tenfold to meet the charging needs of an estimated 27M electric vehicles on the road by 2030. The number of charge points in the US is poised to grow from about 4M in 2023 to an estimated 35M in 2030.

Federal government incentives fueling EVSE growth

The Biden Administration’s Bipartisan Infrastructure Law has earmarked $7.5B for EV charging and the build out of a national electric vehicle charging network along designated Alternative Fuel Corridors, mostly along the Interstate Highway System. Also, the Biden administration has established the NEVI program which provides $5B in funding over five years to help states build a coast-to-coast network of qualifying fast chargers.

In September 2022, the Federal Highway Administration approved the Electric Vehicle Infrastructure Deployment Plans for all 50 states, Washington DC, and Puerto Rico, granting them access to FY22 and FY23 NEVI funding covering approximately 75,000 miles of federal highways nationwide. Along with the NEVI program, a $2.5B Discretionary Grant Program aims to increase EV charging access in rural and underserved communities, along with the Inflation Reduction Act’s $3B dedicated to supporting access to EV charging for economically disadvantaged communities.

Made in the US

Currently, many critical EV components are sourced in Asia and US manufacturers have to import them via a costly and geopolitically risky 50,000-plus mile global supply chain. US battery manufacturers alone are estimated to spend more than $150B overseas on key inputs by 2030.

NEVI funding is designed to mitigate these EV supply chain risks and cost penalties and be sync with the Federal Highway Administration’s Build America, Buy America Act, which is encouraging the reshoring of manufacturing investment from China and elsewhere.

NEVI includes two phases announced by the agency in February 2023. First, starting March 23, 2023, manufacturers were required to conduct final assembly and all manufacturing processes for any iron or steel charger enclosures or housing in the US. Second, by July 2024, manufacturers must also domestically source at least 55% of the cost of components used in charging equipment. As a result, the EVSE industry is one of the hottest sectors of the corporate site selection and economic development fields in the US today.

Top EVSE plant locations in the East, West and Central US

Tops in the East: North Charleston, South Carolina

North Charleston in Berkeley County, South Carolina, is situated in a new and growing US manufacturing corridor stretching from Michigan to Georgia and taking on the name of “America’s Battery Belt”. It is a region housing many EVSE parts manufacturers, several EV assembly plants and where hundreds of GWh a year of battery cell production capacity will be built and start operating between now and 2030.

Berkeley County is also home to the newly announced plant of Carson City, Nevada-based Redwood Materials which will recycle, refine and manufacture anode and cathode components creating more than 1,500 jobs and investing $3.5B in the greater North Charleston area. Redwood takes in end-of-life batteries, breaks them down to their basic metals (nickel, copper, cobalt, and lithium), and then rebuilds those metals into cathode and anode products, the most expensive components of an EV.

Also in Berkeley County, Volvo is hiring 1,300 additional workers at its assembly plant 30 minutes northwest of North Charleston to produce its new and fully electric SUV model – the EX90.

Tops in the Central U.S. Region: Chattanooga, Tennessee

Chattanooga will soon be home to the nation’s largest EV “living testbed,” thanks to $9.2M in federal funding for a project proposed by local officials and scientists at the University of Tennessee at Chattanooga (UTC).

The idea behind the Chattanooga testbed is a networked system that lets EV drivers better find charging stations. Charging opportunities will be customized for drivers as a result of the system recognizing the charge level of individual EVs, volume and pace of traffic, and electric grid power demand to recommend charging stations and types by locations.

Also in Chattanooga, Volkswagen is launching production of its new all-electric ID.4 SUV. The plant employs about 4,700 employees, including 1,000 new hires brought on specifically for its new EV line.

Tops in the West: Minden, Nevada

Minden is a popular submarket of the Reno, NV, metropolitan area where Tesla recently was awarded more than $330M in tax incentives for the company's expansion of its sprawling EV Gigafactory northeast of Minden, including the construction of a massive, new semi-electric truck factory.

PepsiCo plans to roll out 100 Tesla Semis in 2023 first in California where they are fully operational driving a 400-mile radius delivering PepsiCo products for its Frito-Lay unit. In addition to PepsiCo, United Parcel Service and food delivery company Sysco Corp have also reserved the new Tesla Semis.

Noteworthy about Tesla’s northern Nevada expansion is its decision not to locate the production of its new electric truck at its Texas Gigafactory, as predicted by many industry analysts. The greater Minden-Reno area has been a popular landing spot for many companies and people relocating out of the costly Bay Area of California – a three-hour drive away via Interstate 80.

EVSE costs under the microscope

Historic levels of inflation, new corporate tax hikes, and recessionary headwinds are all causing a greater focus on comparative operating cost structures in corporate relocation decisions, especially in the electric vehicle industry where a typical new EV costs some $10,000 to $20,000 more than a traditional gasoline car. Many site-seeking companies in the EVSE industry are concluding that improving the bottom line on the cost side of the ledger will be far easier than on the revenue side in 2023.

Cost differentials between an acceptable EVSE industry site and an optimum location can be substantial even within a given US region. Itemized annual operating costs are detailed in the following table for several high and low-cost EVSE cities included in the new Boyd Report.

What it costs to operate an EVSE Plant: The highs and lows (1)

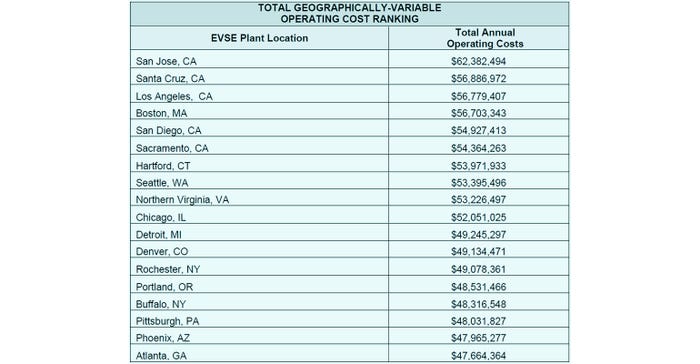

Total annual operating cost ranking

Shown below is a ranking of all 30 surveyed EVSE industry locations. Annual costs include labor, taxes, real estate, construction and utilities and are scaled to a 150,000 sq. ft. EVSE manufacturing plant employing 500 hourly workers.

Annual operating costs were projected solely for comparative purposes, with only major geographically-variable factors being considered. Those costs not varying significantly with geography, including relocation and start-up expenses, were not considered. The Boyd analysis focuses on those key operating cost elements considered to be most pivotal within the corporate site selection process.

About the Author(s)

You May Also Like