How Canada Surpassed China in Global Li-ion Battery Supply Chain Rankings

Bolstered by consistent manufacturing advances, strong ESG credentials, and strategic alliances, Canada's ascends to the top spot in the battery supply chain.

March 6, 2024

Rich in resources and critical in its approach and execution to a zero-emissions climate that exceeds its borders, there’s a new sheriff in town where the battery supply chain is concerned.

In early February, BloombergNEF (BNEF) announced Canada has overtaken China for the top spot in this year’s ranking of battery-industry supply chains, an effort that rates 30 countries on their ability and potential for building secure, sustainable, and reliable lithium-ion battery supply chains.

Now in its fourth edition, BloombergNEF’s “Global Lithium-Ion Battery Supply Chain Ranking” has until now only known one number-one country in its existence, and unsurprisingly it’s been China.

“Canada’s consistent manufacturing and production advances and strong ESG credentials have helped it become a leader in forming the battery supply chains of the future,” BNEF said in its announcement. “Strong integration with the US automotive sector means Canada is also a big winner of the ‘friendshoring’ ambitions of the US Inflation Reduction Act. Canada’s position in the 2024 ranking is propelled by policy commitment at both the provincial and federal level.”

BNEF goes on to affirm China as having the world’s strongest established supply chain, but notes the country needs to be more proactive in environmental action and sustainability across the lifecycle of lithium-ion batteries to benefit its supply chain in the long term.

Power, people, and protocol

Where sustainability is concerned, there are a number of Canadian advantages supporting its battery supply-chain leadership. First is a strong and sustainable power network where clean energy like Quebec-based hydro power projects and other renewables make up 95% of the total, industry sources say. In addition to the ‘friendshoring’ with the US noted by BNEF, Canada has free-trade agreements with the entire G7, and open immigration policies with a solid educational infrastructure providing workforce talent.

Accelerate partnerships

Broad and deep industry support is also a hallmark of Canda’s industrial effort, “Accelerate,” is an alliance of key Canadian companies in mining, batteries, fuel cells, R&D, labor, vehicle manufacturing, and infrastructure, centered on what it calls “a once-in-a-generation opportunity to shape our industrial future and develop a globally competitive Zero-Emissions Vehicle (ZEV) sector.”

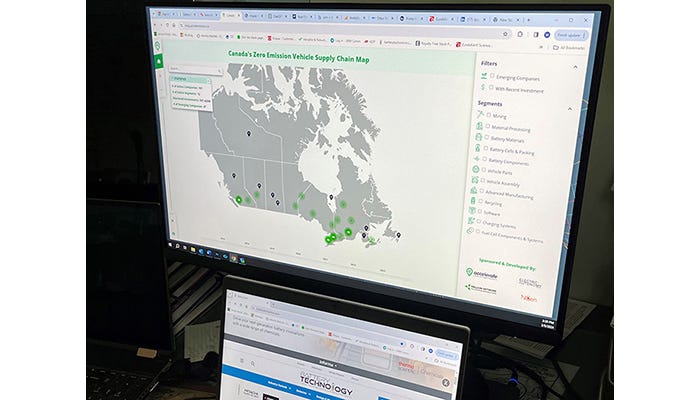

Late last year, Accelerate unveiled an interactive ZEV industry roadmap, (available here) revealing in its scope. It identifies more than 160 companies and their projects located across the country and along a timeline of 2016 to the present. Industries cover battery manufacturing, battery materials, charging systems, fuel-cell systems and components, and recycling, among others. Investments total $3.74 billion to date; “to date” because the battery innovation roadmap is intended to be a living document that will be modified as technology changes and new projects come online.

Accelerate's ZEV industry roadmap on monitor. Credit: M. Anderson

Deep roots, hemispheric reach

A recent visit to Kingston, Ontario, where Lake Ontario meets the St. Lawrence River, reveals the Ontario region is a spotlight of Canada’s overall industrial prowess, with a long history of both being rich in materials resources, particularly mining and manufacturing, and reaching across its border with the US for partnerships and fostering innovation.

In 1940 Kingston was selected by the Aluminum Company of Canada (ALCAN) to build its plant to conduct research and development of aluminum alloys, and manufacture sheet metal, cans, and supplies for major industries such as automotive, transportation, beverage, and packaging. In 2004, Novelis, took over the Kingston site and today manufactures aluminum products for Ford, BMW, Mercedes, General Motors, and Thyssen Krupp.

Solid battery industry credibility has also been building in the Kingston region. Construction is underway on the new $1.39 billion Umicore cathode active material (CAM) production facility in nearby Loyalist, Ontario, forecast to begin supplying North American cell and EV manufacturers in 2026. Kingston is also home to one of Li-Cycle’s “hubs” in its “spokes and hubs” network for recycling batteries and reclaiming and supplying critical materials.

Li-Cycle co-founder and CEO Ajay Kochhar (left) describes battery recycling to Canadian Prime Minister Justin Trudeau and European Commission President Ursula von den Leyen, along with Li-Cycle co-founder and executive chairman Tim Johnston, in a 2023 visit to the company’s Kingston, Ontario hub. Image source: Li-Cycle.

In a recent position paper, “Seizing Canada’s Opportunity: Defining and Building a Successful ZEV Industry,” Accelerate states, “Our country is uniquely positioned to succeed in the transition to electric mobility. For much of the post-war era, Canada has benefited from cross-border trade arrangements that have allowed us to become the world's 12th largest automobile manufacturer, home to numerous major assembly and Tier 1 supplier plants. Canada's geological resources, in turn, are unrivaled, with extensive deposits of the critical minerals required to produce ZEV batteries and motors. It's also significant, in an era when investors are increasingly focused on Scope 1, 2 and 3 emissions, that more than four-fifths of Canada's electricity comes from clean energy sources. Finally, Canada has a well-deserved reputation for the quality of its academic research and innovation output. All these factors position us to succeed in a ZEV world.”

About the Author(s)

You May Also Like