BNEF 2023 Battery Survey: Key Takeaways Unveiled

Explore insights from BloombergNEF's 2023 battery price survey, covering raw materials, localization challenges, regional differences, and future projections.

Lithium-ion batteries have emerged as a leading energy storage technology, powering various devices from smartphones to electric vehicles (EVs) and even stationary energy storage systems. Over the years, lithium-ion battery prices have experienced significant reductions, making them more accessible and attractive for various applications.

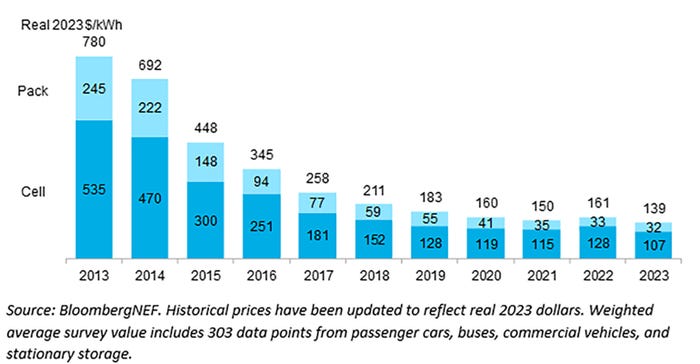

The price of lithium-ion battery packs has dropped 14% to a record low of $139/kWh, according to an analysis by BloombergNEF (BNEF). Yayoi Sekine, head of energy storage at BNEF, stated: “Battery prices have been on a rollercoaster over the past two years. Large markets like the US and Europe are building up their local cell manufacturing. We’re keenly watching how production incentives and tightening regulations on critical minerals will impact battery prices. These localization efforts will add a layer of complexity to how battery prices shape up regionally in coming years.”

Let’s explore the factors influencing lithium-ion battery prices and the trends according to them.

Lower raw material and component costs

Lithium-ion batteries require specific raw materials like lithium, cobalt, nickel, and graphite. Fluctuations in the prices of these materials impact battery costs. For instance, cobalt's limited supply and geopolitical challenges have led to price volatility.

The press release shows lower raw material and component costs contribute to decreased lithium-ion battery prices. The price drop has been driven by the falling prices of raw materials and components as production capacity increased across the battery value chain. Lithium, nickel, and cobalt, critical raw materials for lithium-ion batteries, are expected to ease further in 2024, contributing to the drop in battery pack prices. BNEF expects average battery pack prices to drop again next year, reaching $133/kWh (in real 2023 dollars).

Localization challenges

Localizing battery manufacturing in regions such as the US and Europe could put upward pressure on battery pack prices due to higher costs associated with energy, equipment, land, and labor compared to Asia. Local policies, such as production tax credits, may offset some of these costs.

The report highlights that “On a regional basis, average battery pack prices were lowest in China, at $126/kWh. Battery packs in the US and Europe were 11% and 20% higher, respectively. Higher prices reflect the relative immaturity of these markets, higher production costs, lower volumes, and the diverse range of applications. There was also intense price competition domestically in China this year as battery manufacturers ramped up production capacity aiming to grab a share of the growing battery demand.”

Volume-weighted average lithium-ion battery pack and cell price split, 2023-2023. Courtesy of BNEF.

Battery demand across EVs and stationary energy storage

Despite the remarkable growth in battery demand for EVs and stationary energy storage, major battery manufacturers reported lower utilization rates and demand and revenue fell short of expectations. Evelina Stoikou, energy storage senior associate at BNEF and lead author of the report, stated: “It is another year where battery prices closely followed raw material prices. In the many years that we’ve been doing this survey, falling prices have been driven by scale learnings and technological innovation, but that dynamic has changed. The drop in prices this year was attributed to significant growth in production capacity across the value chain in combination with weaker-than-expected demand.”

As the production capacity for batteries increases, manufacturers can take advantage of economies of scale. This means that the more batteries they produce, the lower the cost per unit becomes. With increased production, manufacturers can optimize their processes and reduce manufacturing costs, lowering consumer prices.

Technology improvements

With ongoing advancements, manufacturers have enhanced lithium-ion batteries' energy density and overall performance. This makes EVs more appealing to consumers and drives down battery prices as manufacturing processes become more efficient.

Over time, advancements in battery technology have led to improved efficiency and performance. This includes developments in cathode chemistry, anode materials, solid-state electrolytes, and cell manufacturing processes. These innovations can result in batteries that are cheaper to produce while still maintaining or improving their capabilities. As technology improves, manufacturers can achieve higher energy densities and longer battery life, ultimately reducing costs.

BNEF forecasts that average battery pack prices will continue to decrease in the coming years. The prices are projected to reach $133/kWh (in real 2023 dollars) next year, reflecting further declines resulting from technological innovation and manufacturing improvements.

Looking ahead, BNEF expects battery pack prices to decrease significantly to $113/kWh in 2025 and $80/kWh in 2030. These reductions are anticipated to be driven by ongoing advancements in technology and improvements in the manufacturing processes of batteries. The industry continues to shift towards the adoption of lithium iron phosphate (LFP) cathode chemistry, which offers lower average prices compared to lithium nickel manganese cobalt oxide (NMC) cells. In 2023, LFP cell prices fell below $100/kWh for the first time.

About the Author(s)

You May Also Like