Samsung SDI Breaks Records in 2023 with Soaring EV Battery Sales

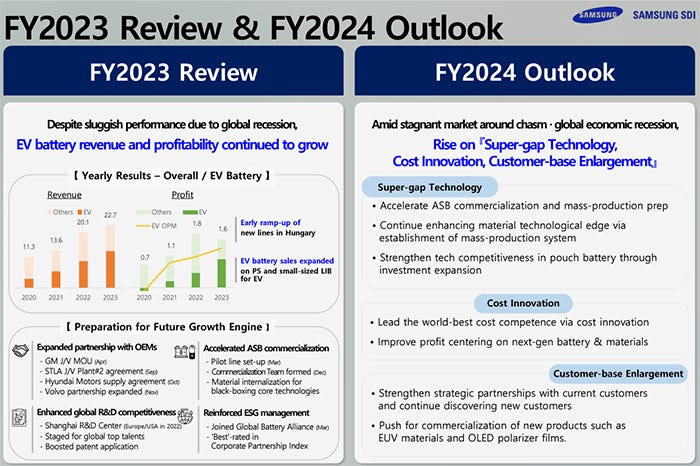

Despite a global slowdown in electric vehicle (EV) growth, Samsung SDI reports an all-time high annual revenue of 22.7 trillion won ($17 billion) driven by robust sales of premium EV batteries.

As we recently reported, Samsung SDI had a robust 2023: Now, in its fourth-quarter 2023 earnings report and conference call on January 29, Samsung SDI put some numbers behind that perception: The company announced a 12.8 percent revenue increase, reaching a formidable 22.7 trillion won ($17.1 billion). The stellar performance is attributed to a remarkable 40 percent surge in sales of EV batteries, leading to a staggering 93 percent growth in operating profit compared to 2022.

However, the overall operating profit saw a 9.7 percent dip to 1.6 trillion won ($1.2 billion), influenced by slower sales in small batteries and electronics materials.

Navigating market dynamics: a shift to premium EV batteries

Acknowledging challenges in the market, Yoontae Kim, Samsung SDI VP of Business Management Office, noted, “Sales of mid-to-large batteries like Gen. 5 increased, though sales remain sluggish in the fourth quarter.”

Despite the anticipated global EV demand slowdown in the coming year, Samsung SDI strategically focuses on boosting revenue and enhancing profitability. The emphasis is on the P5 and P6 premium batteries, anticipating sustained demand.

Jongsun Park, Samsung SDI Executive VP Automotive and ESS Battery, stated, “Sales of P6 might not take up a large portion in the first quarter this year, but from the second quarter, beginning mass production, it will reach a double-digit share within the charismatic batteries’ annual revenue."

Image courtesy of Samsung SDI

Facing the expected global EV demand slowdown

Park also addressed the “chasm phenomenon,” recognizing a temporary decrease in EV growth rates post-market penetration saturation. He emphasized, “According to third-party market research firms North America, which has a relatively low EV penetration rate is expected to show an annual growth rate of over 50%, which is much higher than that of last year, thanks to the benefit of IRA.”

Addressing concerns about the "Foreign Entity of Concern" requirement in the Infrastructure Investment and Jobs Act (IRA), Park stated the company would share its supply chain strategy post US authorities' response, including a request for a grace period for graphite.

Regarding the highly anticipated next-generation all-solid-state battery, Samsung SDI is poised for advancements, the company stated. The newly established ASB business team aims to analyze test results and secure large-scale production capacity and technology for high battery capacity, with mass production scheduled to commence in 2027.

About the Author(s)

You May Also Like