Thanks, IRA! North America Is Fastest-Growing Region for Battery Factories

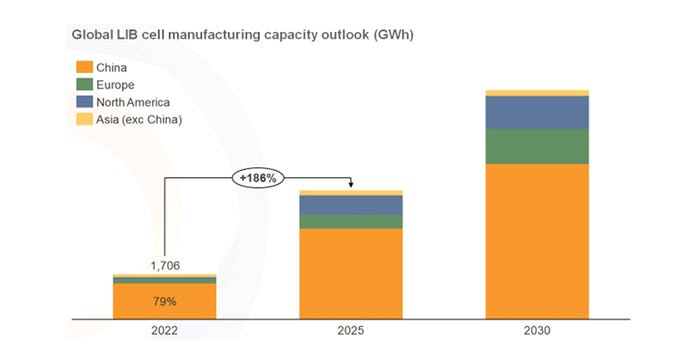

CEA Report: North America is quickly adding IRA-fueled capacity, though China remains the leading manufacturing hub for battery cells. Meanwhile, Europe faces delays and cancellations.

Since the signing of the Inflation Reduction Act (IRA) into law last summer, we’ve been kept busy trying to keep up with all of the announcements of new battery factories and related production facilities coming to these shores: Our Battery Building Spree website subsection has been updated more than 20 times since last September, most recently on May 23—and there’s been more battery factory news since then. So, while it isn’t a complete surprise to us, it’s nonetheless good to have our suspicions confirmed:

By the end of 2022, North America had become the fastest-growing regional market for planned new battery cell manufacturing plants, according to the latest Clean Energy Associates (CEA) latest Energy Storage System Supplier Market Intelligence Program (SMIP) report.

The report attributes much of this growth to incentives the US Inflation Reduction Act (IRA) provides.

In the executive summary, CEA noted that:

China remains the leading manufacturing hub for battery cells, but its share will decline in the coming years.

Measured by planned cell capacity—fueled by the IRA—North America became the fastest-growing regional market.

Europe witnessed delays and cancellations of several planned production facilities, due in large part to high energy prices and more attractive policy support from other regional markets.

Increased market fragmentation is expected, as the expansion of the ESS market will enable the growth of Tier II/III suppliers currently unable to deliver scale for EV buyers.

Lots of US activity—but Asia still dominates

The report’s executive summary emphasizes the difference between “fastest growing” and “largest,” however. Not only are the majority of cell providers based in China—a list that includes CATL, BYD, Gotion, EVE Energy, CALB and SVolt, among others—the non-China capacity is dominated by Korean and Japan-based companies.

Still, the burgeoning North American battery factory activity is notable. CEA lists examples from the current project pipeline, including:

American Battery Factory (ABF), founded by Lion Energy, will build a network of LFP battery factories in the U.S., with its first factory in Tucson, Arizona. The company plans to build LFP battery cells for both EV and ESS applications.

California-based Amprius Technologies will build a 5 GWh factory (in phases) in Colorado. The first phase, with 0.5 GWh capacity, will come online by 2025.

Canada’s battery manufacturer Electrovaya will build the EV battery plant in Chautauqua County with around 1 GWh capacity.

Envision AESC plans to set up its second EV battery factory in the U.S. in partnership with BMW. The factory will be set up in South Carolina with an annual capacity of 30 GWh.

In partnership with CATL, Ford will set up a 35 GWh LFP cell production facility in Michigan.

FREYR will parallel develop its Giga America and Giga Arctic to gain U.S. IRA incentives. Tax credits offered through the IRA would allow FREYR to receive $37 million/GWh of capacity installed in the U.S.

The executive summary of the report can be downloaded for free and a complete copy can be requested for purchase here.

About the Author(s)

You May Also Like