NREL Battery Supply Chain Modeling Tool Tracks Materials

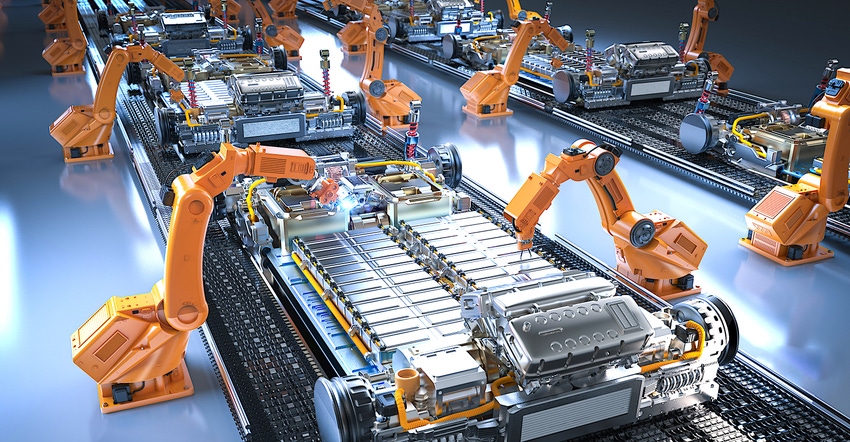

Modeling the battery supply chain is critical to addressing its constraints.

The Covid-19 pandemic laid bare the frailty of global supply chains and the risk of dependence on China for many of the materials and components needed for EV manufacturing.

These issues have been in the sights of the U.S. National Renewable Energy Lab for years, and now that there is a greater appreciation for these issues, NREL’s tracking tool for modeling the supply of materials and components is attracting interest.

This modeling tool is called the Lithium-Ion Battery Resource Assessment (LIBRA) model, which uses powerful system dynamics modeling to analyze the supply chain and evaluate the economic viability of li-ion battery manufacturing, reuse, and recycling.

The Department of Energy is a prime customer of the model, but the scramble by battery and car manufacturers for resources has brought them to NREL’s door too, reports Margaret Mann, manager of NREL’s Mobility Infrastructure and Impacts Analysis group. She declined to reveal which manufacturers they are in a discussion with Design News but says that recent events have accelerated interest from industry.

Primary Purpose

NREL was first concerned about the loss of America’s manufacturing base for solar cells, as companies shifted production to China in the early 2000s. About eight years ago, they noticed the same thing happening with battery manufacturing and created LIBRA to model the problem, according to Mann.

The model’s primary purpose is to war game various scenarios in a bid to see what inputs could produce desirable results and also to get a glimpse of potential negative outcomes from different inputs. “It’s not a crystal ball. It is not predicting the future. It is a ‘what-if?’ time machine given different starting points and scenarios,” Mann explained.

“LIBRA can compile and simplify how various factor changes—such as costs, battery adoption scenarios, and international actions—affect long-term trends in the battery supply chain,” she said. “LIBRA offers a detailed and consistent approach to guide research and investments to secure the Li-ion supply chain, optimize recycling processes, and ensure resiliency and sustainability for nationwide grid and vehicle electrification.”

Other Aspects

The LIBRA model not only tracks the movement of lithium, cobalt, nickel, and other elements through the supply chain, but it also accounts for the potential input of recycling, as battery raw materials join the circular economy.

It also looks at choke points, such as the refining of raw materials into useable forms, which has substantially shifted to China. “Other places do produce cobalt, but China dominates,” Mann said. “Even where refineries are established, it gets sent to China for cathode manufacturing.”

In addition to EVs, other industries also use batteries, so the LIBRA model also tracks consumer electronics and grid storage batteries to understand interconnections between battery manufacturers and market demands, including future applications and developments.

Not for Ethical Sourcing

While it does track what countries produce and refine materials for batteries, LIBRA is not useful for tracking the provenance of materials like cobalt, that are too often sourced from mines that do environmental damage or that exploit workers. Carmakers have committed to tracking the sources of the materials used in their batteries to avoid such sources, but LIBRA can not help in that task.

“This tool does not track that,” said Mann. “There are a lot of sources. It is not just ethical concerns. There is also the issue of identifying secure sources,” she noted. “And what’s the impact on communities where these resources are pulled out of the ground? As we grow these suppliers we want to make sure they are produced in a way that they don’t harm disadvantaged communities and labor laws are respected and enforced.”

What LIBRA does track is the complicated interaction between various materials. “Researchers have tried to reduce cobalt use in batteries, but that increased nickel use,” Mann said. “A fifth of nickel comes from Russia.” Under the current circumstances of the Russian war, that nickel isn’t accessible, so “supply chains have to be global and resilient and make sure you have multiple sources,” she said.

LIBRA’s primary user is the Dept. of Energy, which uses the projections to gauge how to best invest for industry growth. But the model is readily available to carmakers and there’s even a public-facing interface that allows people to run analysis.

It is important to map the best map to the desired result of a strong domestic battery industry, because of its implications for employment, said Mann. “The number of jobs is a really high number and we want to make sure the investments aren’t just shipped overseas,” she said.

About the Author(s)

You May Also Like