The 8 Most Important Materials That Will Drive the Battery Market

As the EV market continues to grow, the need for certain battery raw materials could become critical.

September 20, 2021

In 2012, global electric vehicle (EV) sales total around 125,000 vehicles. Last year, in 2020, that number (including both battery EVs and plug-in hybrids) totaled 3.2 million—for 2021 the estimates are that worldwide EV sales will top 6 million. By 2030, there are estimates that the number will be 30 million new EV sales per year. As the volumes continue to grow so dramatically, so too must the production of the raw materials necessary to build the batteries that power those EVs. Currently, the world battery demand is about 280 gigawatts (GW)—by 2030 that demand could be between 2,000 and 4,000 GW (2-4 terawatts).

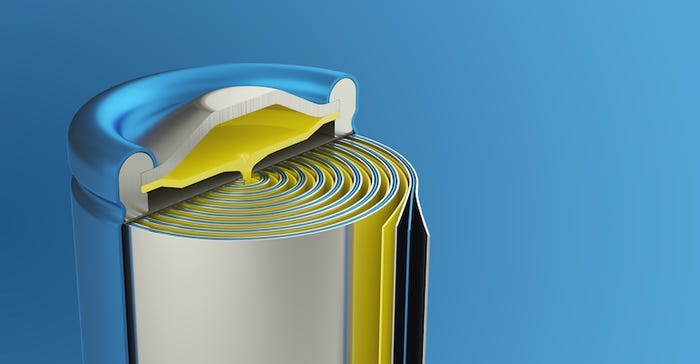

The battery of choice uses lithium-ion chemistry, with either a nickel-cobalt-manganese (NCM) or lithium-iron-phosphate (LFP) cathode material. NCM batteries have significantly higher energy densities which provide a longer range for EVs but at a significantly higher price.

Because NCM lithium-ion batteries meet the needs of many EV drivers, they will continue to dominate the market. There are a variety of supply concerns that are associated with these batteries, however, including sourcing of materials like nickel, cobalt, and lithium to make the battery cells.

During The Battery Show in Novi, Michigan in mid-September, the topics of battery raw materials, refining, and alternative battery chemicals were actively discussed. Here are some of the insights we picked up from a variety of presentations and discussions among some of the top battery thought leaders.

Kevin Clemens is a Senior Editor with Battery Technology.

About the Author(s)

You May Also Like