1 Year On, Companies Leverage the IRA in Surprising Ways

A year after the Inflation Reduction Act was signed into law, battery companies in the US and abroad strategize to reap its benefits—and dodge its regulations.

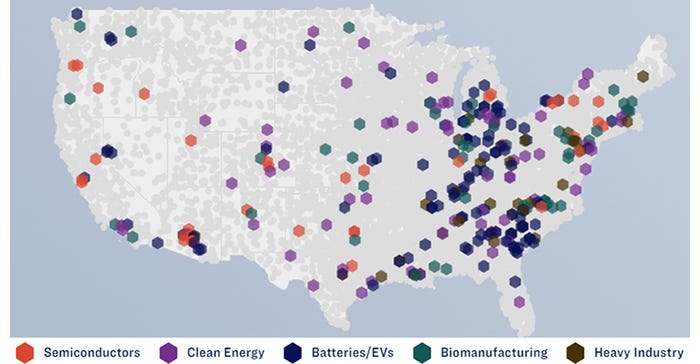

In the year since the Inflation Reduction Act (IRA) was signed into law in August 2022, it has sparked a blizzard of activity by companies in the battery supply chain. According to the Biden administration, as of July private companies have invested more than $503 billion so far, with $103 billion specifically in electric vehicle and battery manufacturing. According to a July AP report, “nearly 80 major clean energy manufacturing facilities have been announced, an investment equal to the previous seven years combined.” (We’re trying to keep up with the battery manufacturing facilities building spree—but it’s been a challenge.)

What’s interesting is how, even a year later, companies are still making news not only for ponying up the money needed to build or expand facilities in the US but also for how they are finding ways to take advantage of loopholes and less-discussed clauses in the law.

From China to South Korea to the US

For example, The South China Morning Post (SCMP) reported this week on Chinese companies showing a keen interest in investing in South Korea's battery industry, aiming to use it as a gateway into the US market. This move is challenging the efforts of the US government to limit China's role in the electric car supply chain.

“Over the past four months, Chinese companies and their Korean partners have announced some 5.1 trillion won (US$4 billion) of investments in five new battery factories in South Korea,” the report noted. “And at least one local government is in talks for more projects, officials from the Saemangeum Development and Investment Agency say.”

This joint initiative by Chinese and Korean companies seeks to leverage South Korea's free-trade agreement with the United States. They are considering the benefits of manufacturing batteries in South Korea and then incorporating them into electric vehicles manufactured in the US. Such a strategy could make them eligible for tax incentives outlined in the IRA.

Specifically, China-based Ningbo Ronbay New Energy Technology Co. revealed last week its approval to establish a factory in South Korea. This facility is set to become a major producer of around 80,469 tons of ternary precursors annually. These precursors are essential components used to create cathodes.

And in March, South Korea’s SK On revealed a partnership with a Chinese company to establish a precursor factory. Earlier this year, Zhejiang Huayou Cobalt Co. entered joint ventures with a chemical arm of LG Group and Posco Future M Co. In June, Posco Holdings Inc. struck an agreement with China's CNGR Advanced Material Co. to construct a nickel refinery.

“China and South Korea, we need each other,” stated Lee Myung-kyu, an official at the Korea Battery Industry Association in Seoul (as quoted by SCMP). “Korean cell makers feel it’s risky to import battery materials like cathodes and precursors from China due to the IRA. If those raw materials are all made in South Korea, that means Korea will have a more stable supply chain in the country.”

The recycling clause and domestic content

Speaking of the materials supply chain: Last week, CBS News reported on companies taking advantage of a “small clause” in the IRA that is benefiting them while also bolstering recycling. This is due to a specific component within the legislation called the “Advanced Manufacturing Production Credit.” This clause offers a decade's worth of tax credits for domestically producing battery cells and modules.

Interestingly, this provision extends subsidies to batteries recycled within the US—regardless of their source. The policy brings dual advantages since automakers using battery materials recycled in the US become eligible for electric vehicle production incentives as well.

The IRA changes how domestic battery makers can provide enough batteries the growing EV market demands, battery material manufacturer Ascend Elements CEO Mike O'Kronley told CBS MoneyWatch according to the report. With the aid of two grants totaling $480 million from the US Department of Energy, Ascend Elements intends to construct a manufacturing plant in Kentucky. The facility is slated for an opening in the fourth quarter of 2024.

Currently, China dominates not only battery manufacturing but also the mining and processing of the crucial raw materials—including lithium, cobalt, manganese, and nickel—needed for battery making. There’s no reason to think that’s going to change any time soon. And that makes for a risky supply chain.

But the reasoning behind the IRA clause that allows the recycling of batteries from any source seems to be that reclaiming the hard-to-get metals domestically keeps those still-crucial metals in the domestic supply chain. And thereby strengthening it, by a degree—one reclaimed battery at a time.

The good news is that existing batteries can be recycled “infinity times” O'Kronley told CBS.

And even though the amount of these metals has been reclaimed for reuse has been minuscule to date, it should increase quickly as battery production surges to meet demand. In a recent Reuters report, Consulting firm Circular Energy Storage predicts that the quantity of EV batteries suitable for recycling is projected to increase by more than ten times by the year 2030.

Meanwhile, numerous recycling companies such as Ascend Elements, REcycLiCo, and others are building up to meet the coming demand for these recycled metals—encouraged by IRA and other US Department of Energy funds.

The IRA is now one year old—and the nationwide electrification it’s designed to encourage and support is still in its infancy. That “small clause” CBS News cites has big ramifications for the future battery supply chain.

About the Author(s)

You May Also Like