2023 Battery Report: Unveiling Key Trends, Industry Insights

Unlock insights from battery experts Nika Ptushkina and Charlie Parker on the 2023 Battery Report by the Volta Foundation. Discover critical trends, surprises, and future industry developments.

The 2023 Battery Report by the Volta Foundation has been unveiled. The 290+ page report claims to capture the dynamic landscape of progress and recalibration in critical areas such as industry, investments, manufacturing, supply chain, innovation, research, policy, and talent. Notable highlights include a 16% reduction in cell-level prices, a renewed focus on graphite facilities outside China, and a surge in Na-ion battery research. The report, a collaborative effort involving 120+ battery professionals from 100+ institutions, reflects the industry's remarkable pace and aims to facilitate understanding while sparking essential dialogues about the future trajectory of batteries. Explore the full report here.

Battery Technology spoke with Nika Ptushkina, Director of Marketing & Strategy at Volta Foundation, and Charlie Parker, Principal Consultant & Founder at Ratel Consulting LLC. Both professionals played pivotal roles in crafting the recently unveiled 2023 Battery Report. As key contributors to this in-depth analysis, Parker and Ptushkina offer distinctive viewpoints on the industry's advancements, unexpected revelations, and prospects. Join us as we delve into their insights, providing an illuminating exploration of pivotal trends, surprising elements, and the nuanced dynamics propelling the battery industry toward a future charged with innovation.

BT: Can you tell me a little bit about your role in this massive undertaking?

Parker: I've been a co-author for three years now, and, in that time, I have worked on markets, policy, and techno-economic analysis. My focus this year was on manufacturing processes and technology throughout the value chain.

Ptushkina: I was Parker’s co-author on the Cell and Pack Manufacturing section. For a quick background, I'm a product manager at PDF Solutions, a manufacturing software company active in the semiconductor and battery industries. I work closely with cell manufacturers, and manufacturing and cell quality are my passions, hence my contribution to this year's report. I'm also the leader of Women in Batteries at Volta Foundation.

BT: What do you think were the most important developments of 2023?

Parker: Global demand is hitting ~1 TWh, and IRA programs are being initiated.

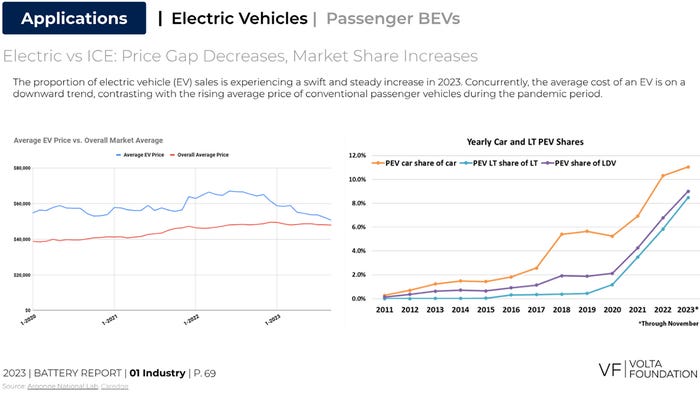

Ptushkina: EV prices have been lowered by 25%, or $15,000 since September 2022. The price gap between EVs and fossils is now under $3,000.

BT: What events or developments came as the biggest surprises?

Parker: Rapid performance improvements and time to market for low-cost chemistries.

Ptushkina: We all know there is a knowledge gap in North America, but it's surprising to see the evidence in terms of salary, with junior battery engineers making, on average, $110K in states like Michigan and California.

Electric Vs ICE. Credit: Volta Foundation (CC BY 4.0 DEED)

BT: Would you say the 2023 report makes you more hopeful or less optimistic about the future of electrification?

Parker: More hopeful because of increased industry stakeholder buy-in. There are some exceptions to this, but new interest and support from less likely players has appeared.

Ptushkina: I agree with Charlie—more stakeholder buy-in. The report does show a drag in battery stocks, which may make investors apprehensive. But if we look at IRA funding, it has been claimed mainly by battery manufacturers (as opposed to other areas of clean energy), meaning a lot of capital is going into the success of the battery market.

BT: Do you have an opinion on which of the newer battery chemistries—sodium-ion, sulfur, solid-state, etc.—are the most likely to see widespread adaptation in the coming years?

Parker: LXMO has the potential to displace ternary cathodes at a lower cost; this is especially important in North America and the EU.

Ptushkina: Sodium-ion is a big topic nowadays. It has drawn a lot of interest from investors as it reduces reliance on lithium.

BT: What is consumers' biggest misapprehension about the battery industry?

Parker: EVs are not a panacea, and there will be some tradeoffs in owning one. I think those tradeoffs are becoming more palatable to the average buyer as costs come down, performance improves, and options become more available.

About the Author(s)

You May Also Like