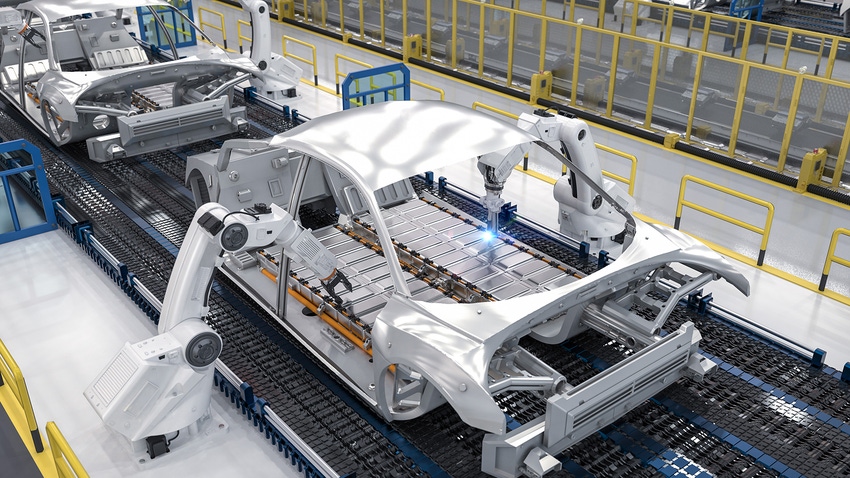

Trends in the EV & Battery Industries That Matter for 2024

Frost & Sullivan’s mobility analysts review 2023’s biggest developments and the most important trends to be aware of in 2024.

As 2023 closes, the EV and battery industries seem to be in a slowdown as manufacturers recalibrate the speed and intensity of their electrification efforts and reassess how fast their customers want them to move. It’s a sobering note on which to enter a new year—but it’s not the whole song, not by a long shot. 2023 saw several watershed events that signal important trends in where the industries are going—and most of these are encouraging and exciting.

Don’t take my word for it. To get an unbiased, expert look at these intertwined industries, I reached out to the Detroit office of Frost & Sullivan, which graciously put me in touch with three of their specialists to discuss (by email) the state of the industry. Here are the significant developments and trends they are watching:

Policy initiatives plus tech advances

“The ongoing evolution of electric vehicle (EV) manufacturing is intertwined with various overarching trends, policies, and industry shifts that are shaping the future of automotive and clean energy sectors,” says Frost & Sullivan Mobility Consultant and battery technologies expert Estella Qi. She offered these examples:

Frost & Sullivan Mobility Consultant Estella Qi (Credit: Frost & Sullivan)

Domestic Raw Materials Security and Incentives: Federal and state incentives aimed at increasing domestic control over the EV supply chain, particularly regarding rare earth elements (REEs) with a focus on incentivizing wholly produced and recycled REEs within the USA, highlight the importance of establishing secure and sustainable raw material supply chains. This presents opportunities for companies with synergistic capabilities to enter the market and contribute to domestic production and recycling of critical raw materials for EV manufacturing.

State Goals on Clean Energy: The transition from internal combustion engine (ICE) vehicles to EVs is complemented by states' commitments to clean energy, with plans to achieve carbon neutrality by 2050. These state goals signal a significant shift in energy requirements, indicating the future demand for battery and vehicle manufacturing as well as charging infrastructure development to align with clean energy objectives.

Vehicle-to-Everything (V2X) Concepts: The pragmatic enactment of V2X concepts showcases the potential for connected electric vehicles to contribute to various aspects of energy management and smart infrastructure. V2H (Vehicle-to-Home) services for backup energy storage, V2I (Vehicle-to-Infrastructure) for smart road management, and V2G (Vehicle-to-Grid) readiness underscore the industry's commitment to leveraging EVs for energy optimization while addressing technical and regulatory integration challenges.

Vertical Integration from Supply Chain to Value Chain: The trend towards vertical integration in the automotive industry extends beyond battery production to encompass the entire value chain. OEMs are not only developing their own battery supply chains but also venturing into developing comprehensive energy ecosystem solutions. This includes expanding into energy storage systems, developing charging infrastructure, and even offering in-house car insurance, exemplifying a shift towards providing holistic energy solutions deriving from EV technologies.

The EV and battery landscape is dynamic and multifaceted, Qi said: “It’s not only driven by technological advancements but also by key policy initiatives, integration of innovative concepts, and the industry's growing commitment to sustainability and energy optimization.” These show an industry “poised to redefine the automotive and energy sectors by facilitating a seamless shift towards a cleaner and more integrated energy ecosystem.”

Innovations and investments

Like Qi, Frost & Sullivan Director for Commercial Mobility Jean-Dominique Bonnet sees the industries as dynamic. “There are several significant developments in 2023 and trends shaping the landscape of battery and electric vehicle technologies for 2024,” he said, and listed the following:

"Year of the LFP" and Tesla's Dual Offering: The prominence of Lithium Iron Phosphate (LFP) batteries has been emphasized, exemplified by Tesla's dual offering of electric vehicles using both LFP and nickel-based chemistries. This reflects a broader industry focus on expanding battery options and optimizing performance for different vehicle segments and markets.

Potential of Silicon Anode Technology: The emergence of silicon anode technology, demonstrated by companies like OneD, holds promise for enhancing battery energy density and overall performance. This development has the potential to significantly impact the capabilities of future EV batteries as silicon anode technology matures and becomes commercially viable.

Evolution from Semi-Solid State to Solid State Batteries: Anticipation is building for the evolution from semi-solid state to solid-state batteries, representing a significant leap in battery technology with potential advancements in energy density, safety, and longevity.

Toyota's Shift to BEV and Solid-State Batteries: Toyota's announced plans to introduce solid-state batteries in their electric vehicles by 2027/2028 indicate a notable commitment to advancing battery technology beyond current limitations, potentially influencing the broader automotive industry's trajectory towards electrification.

Frost & Sullivan Director for Commercial Mobility Jean-Dominique Bonnet (Credit: Frost & Sullivan)

Sodium-Ion Battery Developments: Innovations such as CAT and HiNa Battery's sodium-ion batteries, while currently limited to 160Wh/kg, demonstrate ongoing efforts to diversify battery chemistries and address key challenges such as cost and resource availability.

Battery Plant Investments and Market Growth: Significant investments in battery plants in the US and Canada, coupled with a growing BEV market, reflect both the industry's confidence in the future of electrification and the need for a sustained focus on scaling up battery production in response to evolving demand.

Declining Average Price of Battery Packs: BNEF's findings of a 14% reduction in the average price of battery packs this year, attributed to various factors including declining lithium prices and the impact of LFP technologies, are indicative of the continued maturation and cost optimization of battery technologies.

Lithium Resources and Cobalt-Free Cells: The abundance of lithium resources in locations such as Kings Mountain, NC, and Salton Sea, CA, along with the emergence of cobalt-free cells, underscores the potential for improved sustainability and resource efficiency in battery production.

“The above trends collectively emphasize the dynamic nature of the EV and battery industries, driven by ongoing technological innovation, market demand, and the pursuit of sustainable and efficient energy storage solutions,” Bonnet said.

Impact of broader auto-industry trends

Frost & Sullivan Senior Consultant Anu Jose specializes in Connected, Autonomous, Shared, and Electric (C.A.S.E.) mobility. Jose noted that not only the EV and battery industries but also the automotive industry as a whole is rapidly evolving: “Several notable trends are shaping the development of electric vehicles (EVs) and self-driving vehicles (SDVs), as well as the underlying technologies and manufacturing processes.” For example:

Frost & Sullivan Senior Consultant Anu Jose (Credit: Frost & Sullivan)

Light-weighting Materials and Aerodynamic Efficiency: The use of advanced light-weighting materials such as carbon fiber and multi-material components is enhancing power density and reducing overall weight in electric vehicles. Furthermore, emphasizing aerodynamic efficiency, as showcased by Tesla and Lucid Air, is enabling significant range improvements and energy efficiency in EVs.

Scaling AI in Auto Industry: The integration and scaling of artificial intelligence (AI) in the auto industry are driving innovation across the EV and SDV sectors, significantly impacting rapid design, manufacturing efficiency, and customer experience (CX).

Hybrid/Dual-Chemistry Battery Technologies: Collaborations such as the partnership between BMW and ONE involving hybrid/dual-chemistry battery technologies underscore a concerted effort to optimize the performance and characteristics of EV batteries to meet specific vehicle requirements.

Powertrain Efficiency Improvements of EVs: The ongoing advancements in powertrain efficiency, such as axial flux motors, in-wheel motors, synchronous reluctance motors (SRM), rare earth-free designs, hairpin windings, and unified thermal management systems, are driving improvements in performance, energy efficiency, and sustainability in EVs.

Gigacasting in Car Manufacturing: The widespread adoption of Giga casting, exemplified by NIO's ET5, Geely's Zeekr 009, and Xpeng's G6, enables the production of single-piece aluminum and Mega casted components, leading to improved structural integrity, simplified manufacturing, and potential cost savings. Additionally, GM's acquisition of Tooling & Equipment International (TEI) demonstrates the industry's recognition of Giga casting’s potential and its impact on advancing automotive manufacturing processes.

“The current trajectory indicates a continued emphasis on sustainability, performance, and technological integration in evolving automotive landscapes,” Jose concluded. “These reflect the industry's relentless pursuit of innovation and optimization, from the vehicles themselves to the underlying technologies, manufacturing methods, and operational efficiency.”

About the Author(s)

You May Also Like