JD Power EV Ownership Study Shows Changing Dynamics, Surprising Shifts

JD Power's 2024 US Electric Vehicle Experience (EVX) Ownership Study lists top-performing models and highlights critical shifts in consumer satisfaction.

The JD Power 2024 US Electric Vehicle Experience (EVX) Ownership Study, released on Feb. 27, underscores the evolving landscape as more consumers transition to battery electric vehicles (BEVs). Traditional factors crucial for gas-powered vehicle buyers are now pivotal for BEV owner satisfaction, with quality and cost of ownership identified as primary influencers.

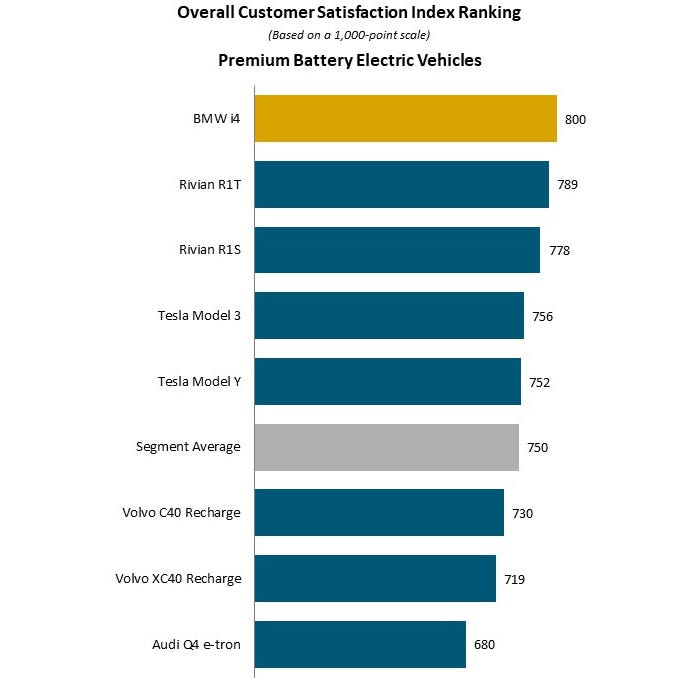

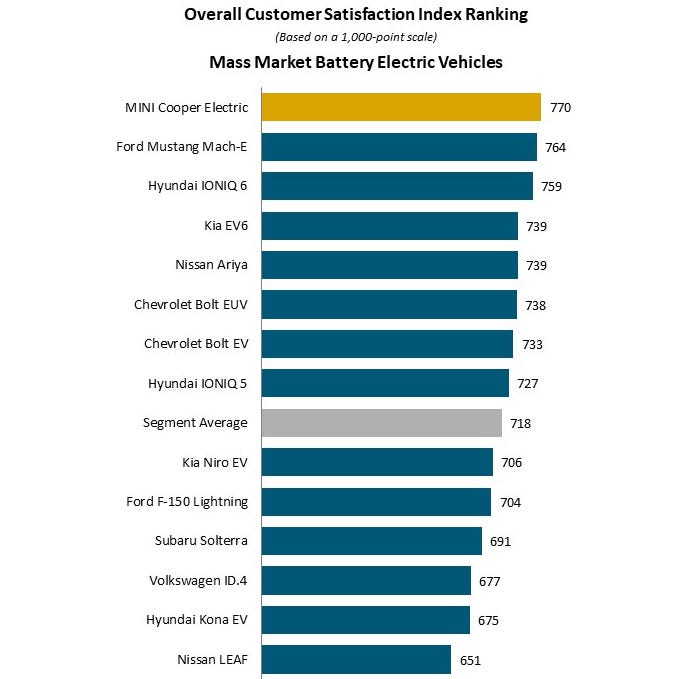

The BMW i4 secures the top position overall and in the premium BEV segment, while the MINI Cooper Electric maintains its standing as the highest-ranking mass-market BEV for the second consecutive year. These rankings are attributed to outstanding performance in the vehicle quality and reliability factor, with both models scoring over 60 points higher than their nearest segment competitors on a 1,000-point scale.

Brent Gruber, Executive Director of the EV practice at JD Power, highlights the notable increase in EV market share and the introduction of seven new rank-eligible models this year, marking a significant stride in the shift toward vehicle electrification. However, he cautions against overlooking the declining satisfaction with public charger availability, emphasizing its importance in addressing the key reasons deterring buyers from BEVs.

Source: JD Power 2024 US Electric Vehicle Experience (EVX) Ownership Study

Charging satisfaction is getting worse

As Battery Technology has covered, there has been a lot of developments in the past year that have the aim of improving EV charging, from increased government funding to cooperation among EV makers, standardizing around the NACS plug, to technical innovations. But as hopeful as those developments may be for the future, they haven't improved the chilly mood of present EV drivers.

Key findings from the 2024 study reveal concerning trends in public charging satisfaction. Non-Tesla owners report a worsening situation, with a 32-point decrease in satisfaction among mass market BEV owners compared to the previous year. Gruber urges the industry to consider this decline as a critical issue requiring prompt action.

Quality and cost of ownership reign supreme

Quality and cost of ownership have emerged as pivotal factors shaping satisfaction among BEV owners, as revealed by the study. Gruber underscores this shift, stating, “Many products are hitting the mark and resonating with shoppers.” However, a concerning trend surfaces—a decline in satisfaction with public charging availability, a key deterrent for potential BEV buyers.

Interestingly, the study indicates that mass market BEVs outshine premium counterparts in quality, with 11 of the 14 ranked mass market models surpassing the premium brand market average in total problems. Gruber emphasizes that quality and reliability are paramount for a positive EV ownership experience, especially as EVs extend into the broader market.

First-time EV owners less satisfied than veterans

Another noteworthy aspect is the satisfaction gap between first-time BEV owners and veterans, expanding from 14 to 28 points in the past year. Overall satisfaction among first-time BEV owners has dropped by 16 points from 2023, with battery range and public charging availability identified as the primary factors contributing to this gap.

While most BEV owners express a willingness to consider another BEV, a substantial portion of first-time owners remains open to alternatives. 48% consider a plug-in hybrid vehicle (PHEV), and 39% are willing to explore hybrid or internal combustion engine (ICE) options. Gruber highlights the industry's challenge in retaining first-time BEV owners, considering their inclination toward alternative technologies.

PHEV owners less satisfied than BEV owners

Contrary to recent news reports suggesting PHEVs as a potential solution to BEV challenges, the study finds PHEV owners, on average, express lower satisfaction compared to BEV owners. The overall satisfaction with PHEVs stands at 629, while mass market BEVs (718) and premium BEVs (750) score significantly higher.

Source: JD Power 2024 US Electric Vehicle Experience (EVX) Ownership Study

In the study rankings, the BMW i4 secures the highest overall score of 800 and leads the premium BEV segment. Rivian R1T (789) and Rivian R1S (778) follow in the rankings. In the mass market BEV segment, the MINI Cooper Electric maintains its lead with a score of 770, with the Ford Mustang Mach-E (764) and Hyundai IONIQ 6 (759) following suit.

The premium segment sees an increase in award-eligible models from five to eight, while mass market models grow from 10 to 14. Average satisfaction among owners of premium EVs is 750, with mass market EV owners averaging 718.

About the study

The U.S. Electric Vehicle Experience (EVX) Ownership Study, now in its fourth year, focuses on the crucial first year of ownership. Covering 10 factors, including accuracy of stated battery range, availability of public charging stations, battery range, cost of ownership, driving enjoyment, ease of charging at home, interior and exterior styling, safety and technology features, service experience, and vehicle quality and reliability, the study benchmarks satisfaction in both premium and mass market EV segments.

Conducted in collaboration with PlugShare, a leading EV driver app maker and research firm, the study gathered insights from 4,650 owners of 2023 and 2024 model-year BEVs and PHEVs. Fielded from August through December 2023, the study provides a comprehensive overview of the EV ownership landscape.

About the Author(s)

You May Also Like