One emerging battery technology that holds tremendous promise is the development of Sodium-ion batteries. Sodium-ion batteries offer numerous advantages over traditional lithium-ion batteries, including cost-effectiveness, abundance of raw materials, and enhanced safety features.

Accenture’s Project Manager Jonathan Helbig will be a speaker at the Battery Show Europe 2023, with a presentation titled “Sodium-ion – the new LFP? Material, cost, and application”. Battery Technology had the opportunity to speak to him about the Sodium-ion battery world.

Accenture Project Manager Jonathan Helbig.

As a project manager at Accenture’s subsidiary, umlaut, can you provide insights into the emerging technology of Sodium-ion batteries and how they compare to Lithium-Iron-Phosphate (LFP) batteries in terms of performance, cost, and sustainability?

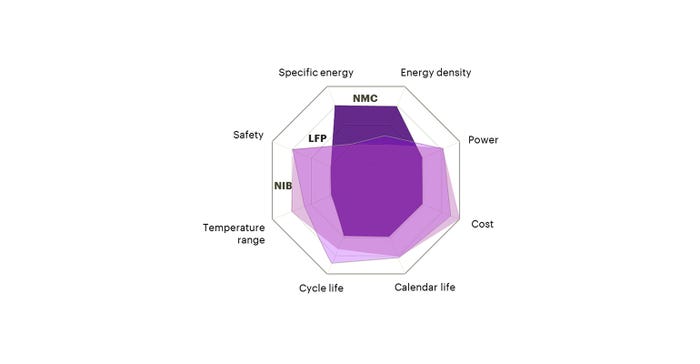

Helbig: Sodium-ion batteries (NIBs) are a well-known and broadly discussed topic in literature. When looking at major key performance indicators (KPIs) of that technology, you can see that NIBs are most comparable to the lithium-ion battery (LIB) technology based on LFP in terms of safety, specific energy and energy density, power, and cost. In some respects, it may even offer advantages such as an extended window of operating temperature, which is crucial for many mobile applications.

Could you discuss any ongoing projects or research initiatives related to Sodium-ion batteries that umlaut is involved in and how these advancements contribute to the development and commercialization of Sodium-ion technology?

Helbig: umlaut has been part of Accenture Industry X since October 2021. The acquisition of umlaut aims to scale Accenture's deep engineering skills. umlaut is involved in projects along the entire battery value chain—from upstream support in mining and raw material production to downstream recycling, which closes the loop. In that area, umlaut and Accenture offer end-to-end services—supporting the client from the innovation to the implementation of a solution/product. Currently, umlaut is supporting active material producers and cell manufacturers around the globe, bringing in-depth engineering and manufacturing expertise to the projects and an excellent understanding of the market.

In terms of scalability and manufacturing, what are some of the key challenges or considerations associated with the production of Sodium-ion batteries, and how do they differ from the manufacturing processes of Lithium-ion batteries?

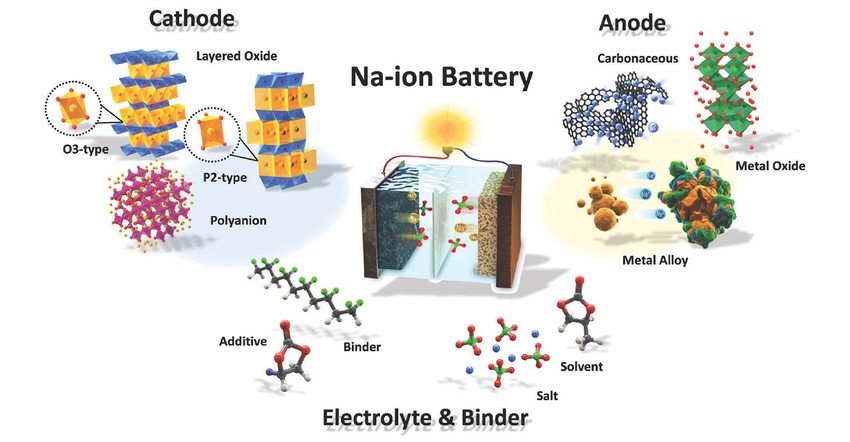

Helbig: The manufacturing for LIBs and NIBs, including all process steps, are overall quite similar. Significant changes are dictated by the use of different materials such as only aluminum as current collectors for NIBs instead of copper and aluminum for LIBs or the use of hard carbon as anode material instead of graphite. The cathode active materials are also different and often demand a dry room environment to protect the material against influences from moisture or CO2. This is no different from the fabrication and handling of high-Ni chemistries for LIBs.

Hence, the overall requirements for a NIB production line are similar to those of a LIB production line leaving the market-leading cell manufacturers the option to easily adapt their lines to a new NIB-product.

Considering the current state of Sodium-ion technology, what is your outlook on its future market potential and the timeline for its widespread commercialization? Additionally, how do you envision Sodium-ion batteries fitting into the broader energy storage landscape alongside other established and emerging technologies?

Helbig: The commercialization will depend on two significant aspects.

Firstly, will NIBs become cost competitive? This question is directly linked to the target application. When comparing NIBs to LIBs, LFP-based cells are the most fitting counterpart. LFP cells can be typically found in all sorts of applications—from the entry segment of EV producers to a good choice for energy storage systems (ESS). The material is cheap compared to NMC and offers a decent lifetime, hence, a good total cost of ownership. If NIBs want to compete with LFP, they first need comparable exceptional KPIs, and all of them at an equivalent lifetime of the battery.

While the commercialization of LFP started 15 years ago, we will hopefully see the start of the NIB commercialization by the end of this year—2023. In this very early phase, predicting how NIBs will perform in the long run is hard. A variety of cathode active materials (layered-transition-metal-oxide-based, phosphates, and Prussian blue analogs) also heavily determine the performance, cost, and impact on the climate change of a NIB. Following the announcements of CATL and based on our own calculations, it should be possible to compete with LFP in terms of cost.

Secondly, why replace an existing technology with a new one offering only minor advantages? To be competitive in the battery market, NIB technology must have major advantages over LIBs or LFP. Otherwise, the commercialization is too big of a hurdle. However, since the production process of NIBs is almost identical to the LIB one, it is not much effort for leading cell manufacturers to switch products.

In the end, this question will be answered at the pack level and not the cell level, where NIBs profit from less of a tendency to go into thermal runaway. This results in reduced thermal management on the pack level, which can compensate for a larger space demand of NIB cells compared to LIBs.

About the Author(s)

You May Also Like