China Alliance Aims To Win SSB Race: How Scared Should Competitors Be?

Government-led CASIP gathers 6 of the top 10 battery companies, including CATL and BYD, plus automakers and researchers to develop solid-state batteries. Worried yet?

The news broke on February 12 that China is intensifying efforts to lead the global electric vehicle (EV) market by uniting battery and car manufacturers in a government-driven initiative to commercialize all-solid-state batteries (SSBs).

The initiative, named the China All-Solid-State Battery Collaborative Innovation Platform (CASIP), was established in January 2024 to create a supply chain for solid-state batteries by 2030. As first reported by Nikkei Asia, CASIP brings together government entities, academia, and industry players, including major EV battery competitors such as CATL and BYD.

Noteworthy participants in the CASIP alliance include battery makers CATL, FinDreams Battery (a subsidiary of BYD), CALB, EVE Energy, and Gotion High-Tech. Significantly, six of the top 10 global automotive battery manufacturers are part of the initiative. Participants include both state-owned and private automakers, such as BYD and Nio.

But it’s not only Industry that’s involved: The Chinese government's involvement is substantial, with key members from the Ministry of Industry and Information Technology, the Ministry of Science and Technology, the State-owned Assets Supervision and Administration Commission of the State Council (SASAC), and the National Energy Administration in the mix.

Global race for SSB implementation

Solid-state batteries offer higher energy density, reduced flammability, and greater flexibility for car designers, promising to extend the driving range of EVs significantly. Toyota and other Japanese companies have traditionally led in solid-state battery research. (Nikkei Asia quotes a Chinese media outlet as asserting “Toyota holds more than 1,300 patents for solid-state batteries, while Chinese battery companies have fewer than 100 for all solid-state batteries.”)

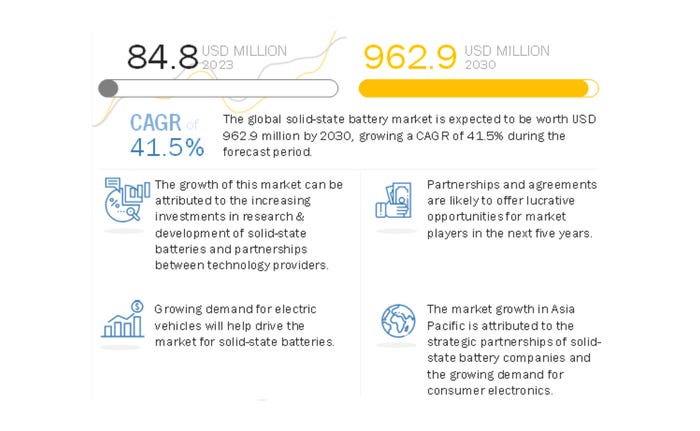

MarketsandMarkets charts the global SSB market. Image courtesy of MarketsandMarkets

Toyota plans to introduce EVs equipped with solid-state batteries by 2027–2028, and Nissan aims to do the same by fiscal 2028. European automakers like Volkswagen and BMW are also actively working on commercializing solid-state batteries in collaboration with startups.

China companies are leaders in the EV battery race, with a major grip on the mining and processing of necessary metals as well as in production and sales. China sees the development of SSB technology by other global players as a threat to that dominance. Hence, the all-in, “whole nation” initiative, getting domestic competitors such as CATL and BYD—which, as Nikkei Asia points out, actively vie for market dominance in lithium-iron phosphate (LFP) batteries—to work together.

Just how worrying is this for China’s competitors?

Media reports on the CASIP initiative use the obvious metaphor of “all-star" sports teams: The idea of the best of the best working together. It’s an apt one as far as it goes (though I like using the equivalent comic-book/movie version: It’s a Chinese Avengers or Justice League approach).

But to my thinking those metaphors don’t really go far enough. A government-empowered bringing together of industrial competitors, plus research labs, universities and government agencies? A better comparison is to the US in the WWII years, when the Roosevelt Administration pulled comparable resources together to quickly build the “Arsenal of Democracy” that produced unprecedented amounts of land, air, and sea armaments for the Allies. (I happen to be writing from about 20 minutes away from the old Willow Run assembly plant that Ford built in 1941 to produce not cars but B-24 Liberator planes.)

And if anything, the autocratic Chinese government can exert more pressure on CASIP members than Roosevelt’s administrators could. I’m trying hard not to say “Arsenal of Autocracy,” but it isn’t easy. In any case, CASIP is a powerful development with the potential to vastly speed SSB commercialization—to the benefit of China.

Analysts respond

Or maybe I need to turn down the Glenn Miller and take a breath. Frost & Sullivan Mobility Consultant Estella Qi, in an email exchange with Battery Technology, reminds me:

“The alliance was formed in Jan 2024, and it’s not a ‘team’ or ‘organization’, but a ‘loosely jointed committee,’ according to one of the founders [as quoted by Nikkei Asia].” In other words, something short of a well-oiled, integrated production machine.

And given the progress competitors are having, it’s no surprise that China has made such a move. Qi again:

“Maxell, Toyota and VW (PowerCo) have announced good news on the development and testing of their All-Solid-State Batteries (SSB) prototypes lately. China recognizes SSB is no longer just a lab product—just as it recognized the significance of EV concepts in 2018. So it is pushing domestic battery suppliers to invest R&D in SSB by forming this committee.”

Frost & Sullivan's Estella Qi (L); Ratel's Charlie Parker (R). Images courtesy of Frost & Sullivan and Ratel, respectively.

But there’s no underplaying the potential of SSB as a global game-changer in the market, according to Qi: “With the serial breakthrough of SSB released recently, we need to care for the potential disruptive product and its impact to global EV market if commercialized,” she warned. “China does the same with the CASIP platform/committee so as not to lose in the incoming industrial shuffle.”

Ratel Consulting Principal Consultant and co-author of the 2023 Volta Battery Report Charlie Parker also weighed in with Battery Technology, noting comparable organizational efforts—but also noting one big difference:

"There is definitely precedence for forming organizations like CASIP which have similar member bodies and stated goals; the semiconductor industry has IRDS, telecom has ETSI, etc.”

However, he continued, “What appears unique with CASIP is the underlying nationalism. Should the remaining SSB ecosystem outside of China decide to pool resources in a similar nature, a technology schism may develop."

About the Author(s)

You May Also Like